GST registration online was very famous after the Goods and Services Tax (GST) big Tax reform in India, which combines earlier applicable indirect taxes & several levies into a single tax structure, which includes central excise duty, services tax, additional custom duty, surcharges, central sales tax and state level value added tax, luxury tax, electricity duty, entertainment tax, entry tax and octroi.

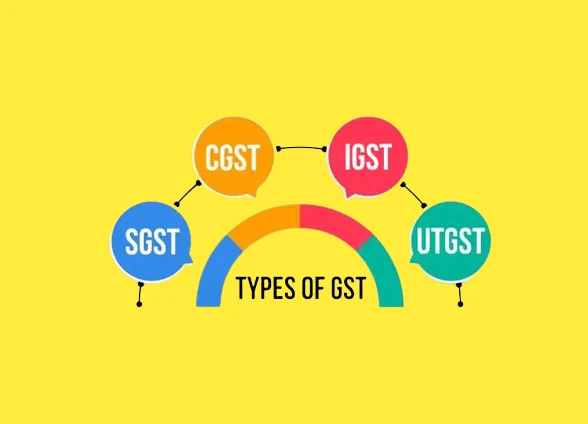

Under the GST regime, goods and services are now taxed under a single legislation, the Goods and Services Tax Laws. All of the taxes are imposed at the same time. The CGST, SGST, and IGST are divide the income between the federal and state governments.

GST registration online is voluntary or mandatory process in India. It depends on turnover of the businesses or services, that the every person is mandatorily apply for GST registration online, who has cross the turnover limit during the previous financial year or expected to cross the limit as prescribed under GST law. Meaning of limit is here from threshold limit.

GSTIN Registration is nessesary for save huge tax penalties or fines, Kcorptax is one of the best online GST registration service providers in Delhi NCR, with the help of our expertization of more than 15 years, you may get registered your business under GST, whether you are from Delhi NCR, Mumbai, Chennai or Kolkatta or from any other place in India.

If you are looking for GST registration online or GST registration process, you can first visit to official website of GST GSTn Services and fill the registration form online and followed the steps as mentioned below. You can also read No. of documents required for GST registration in Delhi and step by step procedure for online GST registration in Delhi.

Also note that, GST online application and procedure for GST registration online in India is same for every State or Union Territory, whether you apply for registration in any State/ Union Territory of India. You can also consult with our GST registration expert team, Kcorptax is one of best GST registration consultant in Delhi NCR.

Businesses that satisfy specific conditions, such as turnover or activity, must register for GST. If the yearly turnover of selling goods or providing services reached Rs. 40 lakhs or Rs. 20 lakhs respectively.

Businesses those have manufacturing goods and delivering services in the northern eastern states, the amounts are Rs. 20 lakhs and Rs. 10 lakhs respectively. Many traders opt to register for GST on their own voluntarily because of the so many benefits.

In India, registration process is only online. GST registration online is ensured a smooth flow of input tax credit & also create your status as a registered supplier.

For more discussion or if you want to get GST registration in Delhi NCR, you may contact us at our offices at Preet Vihar Delhi or Registration Expert (A unit of Kailadevi Corporate) at Greater Noida near Gaur City Mall and get free expert advice or guidance for GST registration online in Delhi and nearby areas.

The following are the general requirements of online registration:

In addition to the mentioned as above, there are a few more conditions that must be satisfied when registration is required. Apart from the mandatory registration, someone may also register on voluntary basis. Kcorptax is ready to help you for GST registration in Delhi NCR.

GST Registration online should applied at GST Portal, open website at google www.gst.gov.in and followed procedure. The provider of taxable goods or services, as well as the location(s) of business, must register for GST in the state from where the taxable goods or services are provided. When a business is locations are spread throughout many states, the GST must be applied from multiple locations. Kcorptax provides GST Registration online services in each and every state of India like as Delhi, Uttar Pradesh, Rajasthan, Haryana, Pujnab, Chandigarh, Uttarakhand, Madhya Pradesh, Gujarat, Mumbai, Kolkatta, Chennai, Kerala, Karnataka, Andhara Pradesh, Orissa, Bihar, Jharkhand etc.

No, a person cannot apply for several GST registrations online at the same time. A person must register for individual GST registration in each state in which he or she does have business operations, whether under the same or different names. An individual with the same PAN but doing business in multiple states is in the same boat. Kcorptax help you to get GST registration services in Delhi NCR or any other states in India.

Once an online application for registration under the Goods and Services Tax Act is received at GST portal, the competent official will review it and, if satisfied, will provide a soft copy of the certificate of registration of GST or if not satisfied then may issue a show cause notice for further clarification. The GSTIN assigned to the applicant is also included on GST certificate. Also you may get help of Kcorptax for notice issued for clarification, Kcorptax have experts for GST registration in Delhi.

A taxable event under the GST Act is a sale, transfer, barter, exchange, license, rental, lease, or disposal of taxable goods or services made, or agreed to be made, for the consideration of taxable goods or services. For more details, you may get consult with our expert team of Kcorptax, we are avialable 24/7 online, our offices in Delhi NCR.

Every person who is subject to GST, whether willingly or involuntarily is required to file the prescribed GST returns in the prescribed manner and within the timeframe or frequencly like monthly or quarterly as specified in law.

Every person can apply for GSTIN, whether voluntarily or mandatorly, with filing an application form for GST registration online at GST portal. Kcorptax is online legal service providers plateform, you can get help of Kcorptax and get free advice also.

In india, GST Registration Turnover limit of selling goods or providing services is Rs. 40 lakhs or Rs. 20 lakhs respectively. Businesses those have manufacturing goods and delivering services in the Northern Eastern States, the amounts are Rs. 20 lakhs and Rs. 10 lakhs respectively. Many traders opt to register for GST on their own voluntarily because of the so many benefits.

Once you get registered under GST then you will laible to pay GST, but will applicable on value addition and net liability need to pay to GST Department, like once you sales of goods or provide services to anyone, you have to file GST return and deposit GST Tax within prescribed dates under GST and you may get credit of GST input Tax also on Input services or taxable goods purchase from registered GST taxpayers with your monthly or quarterly GST return as specified in law.

Yes, you can check your GST registration online status at GST Government Portal i.e. www.gst.gov.in and followed Services>Registration>Track application status>Fill application referance numder (ARN).

Yes, You can pay GST online at GST portal directly through Net banking, Neft or RTGS or can deposit cash in nearest bank after filing GST challan with all mandatory particulars.

Yes, There is no prescribed Government fee for GST registration in India, if you get help of some professionals then need to pay some professional fee, which will nominal or negligible like upto 1500 or 2000 etc. and it may be higher & depends on work or services also.

Yes, you can search it with GSTIN portal, just go on Search Taxpayer > Search by GSTIN/UIN or Search by PAN > fill GSTIN or PAN

Government has prescribed in GST council meeting four Tax slabs under GST i.e. 5%, 12% , 18% and 28%, apart of this Gold Taxable at 3%, and some other rates also, under specific categories or cases.

In India www.gst.gov.in is Government GST portal.

Yes offcourse, you can find GSTIN details including Addresses of GSTIN holders also, after filling their GST No. on GSTIN portal in prescribed field.

Yes, someone can search GSTIN, verify GST certificate details like date of registration, name of GSTIN holders, business place address, return filing dates, ward no., HSN code of goods or services etc at GST Government Portal without login, and after filling his GST number in prescribed search GST Taxapayes tab. In case, if have login details, then you can have two options. First is download GST certifcate from GST Portal go to Services tab>User Services>View/Download Certificates and second is the details get from profile section.

For GST registration in Delhi or any other State, registration procedure is same in entire India, You have to visit official website of GST and apply for GST after followed above details of document required for GST registration & step by step procedure for GST application. You may also consultant with our Kcorptax GST experts team or get free guidance.