In a welcome development for GST assessees, the GST portal has introduced a new facility under the Annual Return (GSTR-9) / Reconciliation Statement (GSTR-9C) module for FY 2024-25: a downloadable Table 12 for HSN details of outward supplies. Annual Return (GSTR-9) / Reconciliation Statement (GSTR-9C) is now Live on GST portalfor FY 2024-25.

What does the new Table 12 (live) download offer in GST Annual return?

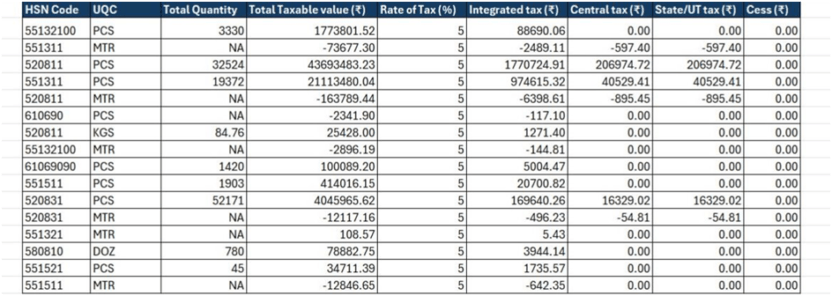

- The utility allows taxpayers to export an Excel file of HSN-wise monthly details of outward supplies, along with a consolidated annual summary.

- This downloadable extract gives better visibility and ease in cross-checking, reconciliation, and correction of outward supply data taken from GSTR-1 (and associated tables).

- In effect, Table 12 becomes more usable: instead of a static display on the portal, taxpayers can now manipulate the data offline (filter by HSN, month, totals) to validate against internal sales ledgers or ERP reports.

This is a useful enhancement in GST annual returns GSTR 9 or 9C (which is available now), especially since HSN-wise summaries are critical in aligning outward supply disclosures with books of accounts and ensuring consistency across multiple tables in GSTR-9 / 9C.

GSTR-9 & GSTR-9C Now Live for FY 2024-25 — Key Dates & Applicability

Portal Go-Live and Due Date for GST annual return filing for FY 2024-25

- The GST portal has enabled filing of GSTR-9 (Annual Return) as well as GSTR-9C (Reconciliation Statement) for the financial year 2024-25.

- The GSTR -9 due date, GSTR- 9C(for both) filings is 31st December 2025.

- Experts have cautioned that the filing window is shorter than in some prior years, making early preparation and filing advisable.

Who must file annual return GSTR-9 and GSTR-9C? (GST annual return applicability)

GST annual return applicable(which depends on turnover limit) for below:

- GSTR-9 (Annual Return) is mandatory for taxpayers whose aggregate turnover exceeds ₹2 crore during the financial yeari.e the turnover limit for a financial year.

- GSTR-9C (Reconciliation Statement) is required for those whose aggregate turnover exceeds ₹5 crore (or the threshold notified) during the year.

- Some categories are exempt from filing GSTR-9: casual taxpayers, non-resident taxpayers, Input Service Distributors (ISD), OIDAR service providers, etc.

- Additionally, where a taxpayer has switched between the composition scheme and the normal (regular) scheme during the year, the annual return form GSTR-9 must take into account that transition.

Late Filing Penalty / Fee Structure for GST annual return filing

- The law prescribes late fees per day for GSTR-9 , subject to a cap (percentage of turnover).

- As summarized in your reference:

- Up to ₹5 crore: ₹50 per day (capped at 0.04% of turnover)

- Between ₹5–20 crore: ₹100 per day (capped at 0.04%)

- Above ₹20 crore: ₹200 per day (cap 0.5% of turnover)

- Taxpayers should plan for buffer time, especially for those requiring GSTR-9C (since audit and reconciliation may take longer).

Role of Table 12 & Importance of HSN Details in Outward Supplies

As new features live now in GSTR-9 / GSTR-9C annual return,Table 12 (HSN details for outward supplies) has long been a key point of reconciliation in the annual return utility. But with the new downloadable version live now, its role is more potent. Here’s why:

- Accuracy & cross-validation

- The monthly HSN-wise breakdown helps cross-verify that the invoice-level data in sales registers / ERP systems matches what’s being reported to the GST system.

- Any mismatch in totals, or omission of particular HSN codes, becomes easier to spot when you can filter and compare side by side.

- Audit readiness

- For taxpayers who must file GSTR-9C, auditors will often check whether outward supply disclosures (by HSN) reconcile with the accounting records. The Excel download gives a ready tool to demonstrate completeness.

- Consistency across tables

- Data in Table 12 is used in various summaries and crosschecks (for example, linking to Table 17 / Table 18 in GSTR-9, or in the outward supply summary). Having the full month-wise breakout helps ensure consistency in roll-ups and avoids discrepancies flagged by validation errors.

- Ease of correction / adjustments

- If a taxpayer detects a missing invoice or misclassification (wrong HSN used), the month-wise view helps pinpoint exactly which period needs adjustment, so corrections or amendments can be done more accurately.

In short, the downloadable Table 12 empowers taxpayers with better control, transparency, and audit compliance.

Key Changes / Enhancements for FY 2024-25 in GSTR-9 / 9C GST annual returns

Besides the Table 12 download facility, there are additional refinements and new features in GSTR 9 that assessees and practitioners should note:

- New sub-tables for ITC reporting (6A1 & 6A2) have been introduced to expand the granularity of credit reconciliation.

- Expansion of Table 6M, possibly to capture more categories or specificity.

- Linkage and tighter checks between ITC reversal / adjustments and corresponding disclosures in the annual return utility.

- Some reporting logic / cross-linking enhancements (e.g., for amendments, credit notes, etc.) have been hinted at in announcements.

All of these point to a trend: the GST system is pushing for more granular alignment between transactional (monthly/quarterly) returns and annual reconciliations.

Filing Workflow: Steps, Tips & Common Pitfalls for GST annual return

Below is a suggested workflow, along with tips and things to watch out for, to make your GSTR-9 / 9Cannual return filing smoother for FY 2024-25.

Workflow Steps

- Complete all periodical filings (GSTR-1, GSTR-3B, etc.) for FY 2024-25

- Ensure all monthly/quarterly returns are properly filed, amended if needed, and reconciled.

- Ensure there are no pending returns or exceptions.

- Reconcile books / ERP data with GSTR data

- Run detailed reconciliation of outward supplies (invoice register vs GSTR-1), inward supply / ITC (purchase register vs GSTR-3B, 2B), reversals, etc.

- Use the downloadable Table 12 (HSN-wise) to verify outward supply alignment.

- Download Table 12 and other relevant extracts

- Use the new facility to extract HSN-wise monthly data + consolidated summary.

- Use that to cross-check with your internal data.

- Prepare the annual return / reconciliation offline

- Use the offline utility (Excel/json) provided by the GST portal to enter data, reconcile tables, and validate.

- Check all cross-table linkages, ensure totals match, and ensure explanations are ready for any mismatches.

- Generate JSON & validation

- After completing data entry and validation in the offline utility, generate the JSON file.

- If there are validation errors on upload, download the error JSON, correct the identified issues in the utility, regenerate & re-upload.

- Self-certify / digitally sign (as applicable) & file

- For GSTR-9C, if required, the reconciliation statement must be signed (DSC or equivalent/self-certification) before upload.

- Final submission must be initiated before the due date (31 Dec 2025).

- Post-filing review & record-keeping

- Download filed returns, keep audit trail, maintain reconciliations and working papers (especially explanations for differences) for possible assessments / scrutiny.

GST Annual return for composition dealers:

Businesses,all those falls in composition scheme or have composition dealersare required to furnish a annual return (once in a year) in form GSTR-4.GSTR-4 will needs to file up-to 30th April, following the financial year.

Tips and Best Practices for Annual return GSTR 9

- Start early: Don’t wait until the last few weeks. Given the depth of reconciliation, technical validations, and possible back-and-forth error corrections, early start matters.

- Use the HSN download wisely: Use filters, pivot tables, etc., to isolate large-value HSN codes and anomalies.

- Maintain reconciliation notes: Wherever you find mismatches in GST return filing (e.g. goods reclassified, free supplies, promotional samples, non-taxable sales), maintain clear working notes and explanations.

- Validate cross-linkages: Ensure that totals of Table 12 (HSN outward) tie into summary outward supply tables in GSTR-9 (Tables 17, 18, etc.). Discrepancy often arises from oversight in roll-ups.

- Test small upload runs: If possible, test uploading intermediate JSONs (with dummy data) to identify portal validation checks early.

- Coordinate with auditors: For taxpayers needing GSTR-9C, involve auditors or cost accountants early in the reconciliation process to align adjustments and commentary.

- Keep buffer for errors: Leave some time before deadline for rework, portal downtime, or system latency.

Common Pitfalls to Watch Out For GST annual return filing

- Mis-classification of HSN codes, leading to mismatches in outward supply summary vs HSN breakdown.

- Omission of inter-branch / distinct location transfers, which may escape outward supply registers but be picked up in GSTR system.

- Mismatch between books & GSTR data in credit / reversal entries.

- Rounding / decimal discrepancies in summations.

- Portal validation errors due to incorrect table linkages or missing explanatory notes.

- Not accounting for amendments / credit notes issued during the year — these must be captured in the proper period and HSN classification.

Significance & Broader Implications

- Better transparency and taxpayer empowerment

- The downloadable Table 12 gives taxpayers their own “data extraction tool” to review, validate and correct the HSN-wise outward supply disclosures. This leads to fewer surprises and more control.

- Stricter data alignment expectations

- Over the years, the GST regime is tightening the consistency between GSTR returns and financial books. Tools like the HSN download reinforce this by making discrepancies more visible upfront.

- Reduced dispute risk

- With better audit-ready records and reconciliations, taxpayers can reduce exposure to assessments and show credible working papers to tax authorities.

- Incentivizes stronger internal controls

- Businesses will be pushed to improve invoice-level data capture, HSN coding discipline, and periodic reconciliations throughout the year rather than at year-end.

- Evolving GST regime sophistication

- Such small yet meaningful upgrades (like download facilities, new sub-tables) reflect the maturity of the GST IT infrastructure — moving beyond data entry constraints to analytic enablement.

Conclusion

The new downloadable Table 12 (HSN details of outward supplies) in the GSTR-9 / GSTR-9C utility for FY 2024-25 is a thoughtful and taxpayer-friendly enhancement. It elevates the usability of HSN-wise data, aids in reconciliation, and strengthens alignment between filed GST returns and accounting records.

New features live now in GSTR-9 / GSTR-9C annual return, however the addition is not just a cosmetic upgrade in GST annual return filing — it coincides with a broader push for greater granularity, audit-readiness, and data integrity in GST filings, evident through new sub-tables, tighter linkages, and validation logic. Given the shorter filing window this year, taxpayers should promptly leverage this facility, follow disciplined reconciliation workflows, and ensure compliance well ahead of the 31st December 2025 deadline.

FAQs for Annual return

1. What’s new in the GSTR-9 & GSTR-9C utility for FY 2024–25?

The GST portal has now introduced several key updates for GST annual return filingfor FY 2024–25. Taxpayers can download Table 12, which contains HSN details for outward supplies, in Excel format. This allows for easier review and reconciliation. Filing for FY 2024–25 is also enabled, making the process more streamlined, accurate, and user-friendly.

2. What is the due date for filing annual returns GSTR-9 and 9C for FY 2024–25?

The due date for filing GSTR-9 (annual return) and GSTR-9C (reconciliation statement) for the financial year 2024–25 is 31st December 2025. Taxpayers should ensure all monthly returns are reconciled well in advance. Filing after the due date may attract late fees, so planning ahead is strongly recommended to avoid penalties.

3. Who must file GSTR-9 annual return?

All regular taxpayers whose aggregate turnover exceeds ₹2 crores during the financial year 2024–25 are required to file GST annual return GSTR-9. This includes businesses registered under the regular GST scheme but excludes composition taxpayers. The annual return consolidates all monthly and quarterly filings, providing a complete overview of sales, purchases, and taxes paid for accurate compliance.

4. Who must file GSTR-9C?

GSTR-9C must be filed by taxpayers with an aggregate turnover exceeding ₹5 crores in the financial year 2024–25. In addition to the filing, taxpayers are required to obtain a certification from a Chartered Accountant (CA) or Cost Accountant confirming that the annual return aligns with audited financial statements, ensuring full compliance with GST audit norms.

5. What does the new downloadable Table 12 include?

The new downloadable Table 12 contains detailed HSN-wise monthly information along with a yearly summary of outward supplies. It shows tax rates, values, and quantities for each HSN code. This consolidated view allows taxpayers to cross-check their monthly GSTR-1 filings, ensuring accurate reporting and making annual reconciliation under GSTR-9C much easier.

6. How can I access the Table 12 download?

To access Table 12, log in to the GST portal and navigate to the Returns Dashboard. Select GSTR-9 for the relevant financial year, locate Table 12, and click on “Download HSN Excel File.” The downloaded file can then be reviewed, verified, and edited as necessary before uploading it during the filing process for accurate annual return submission.

7. Is this data auto-populated?

Yes, the Table 12 data is automatically fetched by the GST system from your monthly GSTR-1 filings. This means taxpayers do not need to manually enter each transaction again, which reduces errors and saves time. However, it is still recommended to review the data to ensure all entries, HSN codes, and amounts are correct before filing.

8. Can I edit the downloaded Excel before filing?

Yes, taxpayers can review and edit the downloaded Table 12 Excel file before filing the annual return. This allows corrections for any missing or misclassified HSN codes, tax amounts, or outward supplies. After making necessary adjustments, the verified data can be uploaded back to the GST portal, ensuring accurate and error-free filing of GSTR-9 and GSTR-9C.

9. Is this applicable for SEZ units?

Yes, Special Economic Zone (SEZ) units and SEZ developers registered under the regular GST scheme can also access and use Table 12. They can download the HSN-wise summary, review outward supplies, and file GSTR-9 and 9C accordingly. However, SEZ units operating under the composition scheme are not eligible for this feature.

10. Are composition taxpayers eligible?

No, composition taxpayers are not eligible for GSTR-9 or Table 12 download. Instead, they are required to file GSTR-9A, which is the annual return specifically designed for small taxpayers under the composition scheme. They do not need HSN-wise reporting, making their compliance simpler but different from regular taxpayers filing GSTR-9.

11. What are the penalties for late filing?

Late filing of GSTR-9 or GSTR-9C attracts a penalty of ₹50 per day for taxpayers with a turnover up to ₹5 crores, and ₹200 per day for those with a turnover above ₹5 crores. These late fees are over and above interest on any outstanding tax. Timely filing ensures avoidance of unnecessary costs and penalties.

12. What’s the benefit of this update?

This update simplifies annual return filing by providing an Excel download for HSN-wise outward supplies. Taxpayers save time, reduce manual errors, and reconcile data more efficiently. It also ensures better accuracy, streamlines compliance, and makes audit processes easier. Overall, businesses can file annual returns confidently without worrying about missing or inconsistent data.

13. Can this data help in audits?

Yes, the consolidated HSN-wise data from Table 12 is highly useful for GST audits. Auditors can easily cross-check monthly outward supplies with the annual return, identify discrepancies, and verify tax payments. It simplifies audit reconciliation, ensures compliance, and helps prepare accurate GSTR-9C statements with minimal manual effort, reducing the risk of errors or penalties.

14. Should I still verify my HSN codes manually?

Yes, manual verification of HSN codes is highly recommended, even though the data is auto-populated. This ensures that all codes, quantities, and descriptions match your actual business transactions. Proper verification avoids misclassification, incorrect tax rates, and potential notices from the tax authorities. A careful review ensures compliance and reduces audit risks.

15. When should I start preparing my filings?

It is advisable to start preparing GSTR-9 and GSTR-9C filings as early as possible. Early reconciliation of monthly GSTR-1 and GSTR-3B data ensures accuracy and allows sufficient time for any corrections. Preparing in advance helps avoid last-minute rush, reduces errors, and ensures smooth filing before the 31st December 2025 deadline, preventing late fees and penalties.

ALSO READ POPULAR ARTICLES

Why should you consider a GST return filing for business

Avoid GSTR-3B Penalties – Correct Filing Process For 2025